How To Set Up Direct Debit As A Business

Pocket-size businesses in the Great britain are dearly in need of a reliable method of collecting payments. According to Bacs Payment Schemes Limited, a total of £14.2 billion worth of overdue payments were recorded in 2022 alone. Modest and medium-sized enterprises (SMEs) brand upwardly almost 99% of the United kingdom of great britain and northern ireland's private business sector, and they're uniquely vulnerable to issues stemming from late payments.

These unpaid invoices or belatedly payments lead to a reduced cashflow, particularly for businesses that provide recurring services. Prolonged cashflow issues in plow reduce these businesses' working uppercase. This may cause serious debts and in the worst cases tin fifty-fifty lead to bankruptcy. One effective fashion to combat cashflow bug is to provide a payment method that puts y'all in control — a method where you define when you lot go paid and how often. This is where Directly Debit comes in.

What is Direct Debit payment?

The Direct Debit scheme is a popular payment method in the UK, in which customers authorise merchants or organisations to pull funds from their bank accounts. All Direct Debit payments are handled by Bacs (Bankers' Automatic Clearing Services), a fundamental payment network that processes several dissimilar types of electronic payments. Direct Debit is ordinarily used for making recurring payments like credit carte du jour bills, utility bills, instalment payments, rent, recurring retainer payments and subscriptions/memberships.

Advantages and benefits of Direct Debit for businesses

Allow the states await at some of the benefits that Direct Debit has to offer:

- Helps y'all gain trust: If you lot are an organization or business organization taking payments through the Direct Debit scheme, you'll exist subjected to a thorough exam and monitored closely past banks. This constant scrutiny volition make your business more transparent, enabling you to gain the trust of your customers.

- Timely payments: Direct Debit allows business owners to get their payments on fourth dimension, avoiding the risks and bug involved in late payments.

- Better cashflow: With Direct Debit, payments for the services and products you offer are ensured. This leads to better cashflow. Amend cashflow, in plough, leads to salubrious working capital. With healthy capital, you can run your business smoothly.

- Direct Debit Guarantee: The Straight Debit Guarantee is a set of protocols followed by banks that accept instructions to pay direct debits. These policies mainly favour the customers and ensure that customers are not liable for incorrect payments. Businesses using the Direct Debit scheme should be very careful about the fourth dimension periods and amounts of the payments they initiate, because the Straight Debit Guarantee refunds the money immediately in the outcome of an error in payment.

- Set-and-forget: The ease of gear up-upwards and the fact that the customer doesn't need to go to the trouble of making payments each fourth dimension, makes this payment method a must for all businesses in the Uk. By providing the direct debit option for your customers, you brand it easier for them to pay you with minimal intervention and this will be a huge plus for conducting business with you.

- Lower failure rate: The overall failure rate at GoCardless for direct debit payments is 2.2%. This is very less when compared to the higher failure rates (five-18%) seen with credit card transactions.

How does Direct Debit work?

To gear up Direct Debit, you must get an potency from your customer to pull funds from their accounts. In one case you get the authorisation, you can take recurring payments from the customer's business relationship. Yous'll be required to ship a observe to the customer x working days earlier the bodily transaction, informing them of the amount and the engagement. The only affair the customers need to do is to ensure that they have sufficient funds in their account.

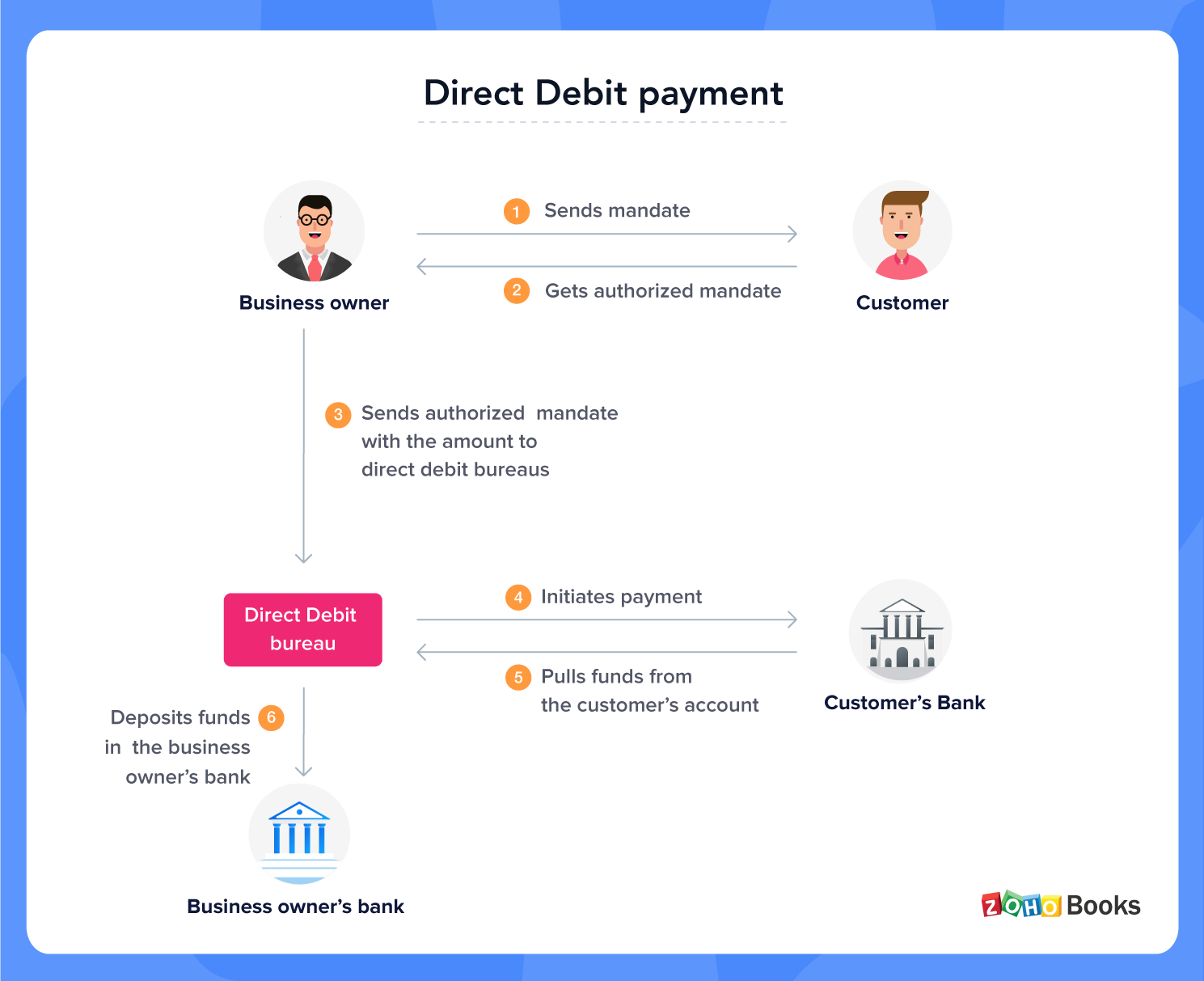

Here's an illustration explaining the bank-to-bank transfer in Direct Debit.

The business organization owner initiates the payment after setting up Direct Debit for their client. The amount of payment and the date of the payment initiation should always lucifer the advance discover yous send to your customer. Funds from the customer'southward bank account go through the Bacs wheel. For the start transaction, it takes five working days for the amount to settle in the business owner'due south banking concern business relationship, but subsequent transactions will be processed in three working days.

How to set Straight Debit to start taking customer payments

To start taking funds from a client'southward account, y'all need to follow these steps.

- Step one: Prepare a mandate or authorisation document for your customer to sign. A mandate should contain the following details:

- Account holder's name

- Bank/building society business relationship number

- Branch sort code

- Depository financial institution/building club's full postal address

- Account holder's contact details

- Service User Number (Sunday) of the originator (auto-filled)

- Payment date

- Payment amount

You can collect these details past sending your customer a difficult re-create of the form or online form to fill up out and transport dorsum to y'all. You can as well use a phone phone call for collecting your customer's details, just the script has to exist approved by a depository financial institution.

- Step two: Become the mandate back from the client and submit information technology to your banking concern. Most banks normally take most 4-vi days to actuate a mandate.

- Step 3: One time the mandate is active, yous are required to notify your customers x days before initiating the actual payment. Information technology takes 3-five working days after the payment date for the funds to settle in your account. If you initiate a payment and it fails, you'll receive a message from Bacs notifying you lot of the reason for failure. Yous will and so demand to speak to your customers to analyze the situation.

How to admission Direct Debit

Bacs provides different options for accessing the straight debit scheme. Y'all can select the most suitable method based on your organisation's fiscal continuing, authoritative capabilities and volume of transactions.

In that location are 2 methods of accessing the Direct Debit scheme:

- Direct admission via a banking company

- Admission via a Direct Debit bureau

Direct access via a bank:

Big businesses or organisations that can manage the Direct Debit process by themselves opt for the direct access method. The organisations using the direct access method are known equally direct submitters. Direct admission has the lowest transaction fees but the initial setup price is very high. For businesses handling large volumes of recurring payments, the low transaction costs outweigh the initial overhead expenses.

The kickoff step to get a directly submitter is to employ for a Service User Number (SUN). Obtaining a SUN is non a peculiarly swift or easy process — information technology tin take months, and banks usually decline businesses that accept a pocket-size turnover or don't seem equipped enough to handle Directly Debit on their ain. If your business meets the following criteria, then the banking company might approve you lot and provide you with a Lord's day.

- Revenue greater than £1 million (some banks even have a threshold of £10 million). Your business needs a huge turnover to fifty-fifty exist considered for approving.

- Well-equipped with both the workforce and the technical expertise required to handle the workload that comes with straight access.

If y'all get canonical for a Lord's day, yous will take to build a system in-house to collect, store and submit the necessary data to Bacs. Bacs approvedstraight debit direction software provides an integrated platform for accessing a range of Direct Debit schemes.

Access via Direct Debit bureau:

If you don't have the necessary turnover or just want to be free from all the extra work of treatment Direct Debit in-house, you can employ a Direct Debit bureau. Directly Debit bureaus are third-party organisations that handle direct debit payments and most of the work related to them on your behalf.

Traditional bureaus only handle the Bacs submission procedure, then you lot yet have to collect the mandates yourself. The bureau procures your customers' details from you and handles all the paperwork like Bacs submission and payment details.

When using a 3rd-political party agency, you tin use either your own Lord's day (Service User Number) or the bureau'southward SUN to make payments. The all-time option is to employ your own Lord's day, because only the proper noun of your business organisation is shown on your client's bank statements. But if yous need the payments to starting time apace and you don't mind the bureau'due south name on your customer's transactions, you tin opt for using the bureau's SUN.

Depending on which agency you choose, it might charge you for the setup of your account, for monthly usage, and for every transaction and submission. Some bureaus besides charge a penalty for each failed payment. Traditional bureaus can be somewhat non-transparent about their costs, so y'all may want to use an online Direct Debit provider instead. Online Direct Debit providers by and large offer amend features at meagre costs for setup and transactions. Some online providers even send client mandates for you. You just have to directly your customers to your online provider and they will take care of the residual.

Direct debit is a simple and sensible culling that gives you consummate command over your payments, including recurring payments. Its depression failure rate and minimal need for manual intervention brand it appealing to customers and businesses alike.

So if you are providing recurring services in the UK and are in search of the best payment method for your business concern, Direct Debit is an selection that has potential to help yous maintain a healthy cashflow.

How To Set Up Direct Debit As A Business,

Source: https://www.zoho.com/books/articles/direct-debit-payments.html

Posted by: maldonadolabitchisiol.blogspot.com

0 Response to "How To Set Up Direct Debit As A Business"

Post a Comment